Flat Tax for Expats in Italy 2026: a €300,000k cap is still competitive for high earners

On December 30, 2025, Italy officially approved an increase to its special flat tax regime for new tax residents, raising the annual lump‑sum tax from €200,000 to €300,000.

Despite the increase, the regime remains advantageous for high‑net‑worth individuals and high‑income earners, particularly when compared to other European nations that levy progressive tax rates reaching approximately 45% to 57% (including Denmark at around 55.9%, France at about 55.4%, Austria at 55%, Belgium at 53.5%, and Sweden at roughly 57%). The regime allows qualifying individuals to pay a fixed substitute tax of €300,000 each year on foreign‑sourced income, while Italian‑sourced income continues to be taxed under ordinary progressive rules and social contributions—providing certainty and often substantial savings for those earning €1 million or more annually.

This option is available for up to 15 years and exempts participants from reporting foreign assets in Italian tax filings, as well as from Italian wealth, gift, and inheritance tax on foreign‑located assets. Most forms of foreign income are included, except that capital gains from the disposal of qualified (substantial) shareholdings realized within the first five tax years remain subject to a separate 26% tax. After this five‑year period, capital gains on substantial shareholdings can generally be brought within the €300,000 lump‑sum.

To qualify, applicants must not have been tax residents of Italy for at least nine of the previous ten years. The regime may also extend to family members for an additional €50,000 per year per person (increased from €25,000), meaning that, for example, a couple could elect coverage at €300,000 for the primary taxpayer plus €50,000 for the spouse, for a total annual substitute tax of €350,000 on their foreign‑sourced income. Regular progressive income tax remains applicable to Italian‑sourced earnings. The regime is intended for individuals with higher incomes, including returning Italian citizens and international professionals, who wish to limit tax exposure in countries with steep progressive tax brackets.

A Practical Tax Solution for Remote Non-EU High Earners

Italy's updated flat tax regime, in combination with the Digital Nomad Visa (introduced in March 2024), presents a straightforward path for non‑EU professionals working remotely to benefit from fixed annual taxation on foreign income. You may be able to pair the flat tax with Italy's Digital Nomad Visa, depending on your specific situation and eligibility. The Digital Nomad Visa permits eligible applicants to work in Italy for foreign employers or clients. To qualify, applicants must generally show:

At least six months of relevant professional experience

Highly skilled status demonstrated by a university degree or equivalent professional qualifications

An annual income of roughly €28,000

Adequate health insurance

Suitable accommodation in Italy

How to combine Italian tax residency with the DN visa

If you're a non‑EU citizen working online and earning significant foreign income—like $1 million USD per year—you may be able to pair the flat tax with Italy's Digital Nomad Visa, launched in March 2024. This visa lets you work remotely for foreign clients or employers in knowledge‑based jobs (like finance) but not for Italian employers. The Digital Nomad Visa and the flat tax are separate frameworks, so holding the visa does not automatically grant access to the lump‑sum regime; you must still satisfy the basic prerequisites of non‑residency in Italy in the preceding years and elect into the flat tax as a new Italian tax resident.

Tax residency in Italy: minimum stay and connections

To benefit from Italy's flat tax regime, you must qualify as an Italian tax resident for the relevant tax year, which generally means spending at least 183 days (half plus one day) in Italy during the calendar year and/or having your primary home and main personal and economic interests there. In practice, this usually involves registering your residence with the local Anagrafe, obtaining a codice fiscale (Italy's personal tax identification number, roughly equivalent to a Social Security Number in the US), and demonstrating that your habitual abode, family life, and core business or professional activities are effectively based in Italy. Even after establishing Italian tax residency, US and Canadian citizens must still consider their home‑country rules (and use treaty relief where available) to manage ongoing filing obligations and avoid double taxation.

When does the flat tax save you money?

Once you're a tax resident in Italy (by spending more than 183 days a year there, or if your main life ties are in Italy), you're eligible for the flat tax, assuming you meet the non‑residency requirements and file the necessary election. This approach benefits people in high‑tax places like New York, San Francisco, Los Angeles, and Toronto, where the combined top marginal rates for high earners in 2026 can still run slightly above 50% when federal, state/provincial and local taxes are added together. In Italy, your tax on foreign income is capped at €300,000, potentially cutting your total tax bill by six figures and leaving you with substantially more net income each year.

Moving your tax residency to Italy makes sense if you're paying substantially more than €300,000 per year in taxes on foreign‑sourced income at home. For example, NYC residents currently pay 10.9% New York State income tax on top brackets and approximately 3.9% New York City income tax. NYC Mayor‑elect Zohran Mamdani has proposed, however, adding 2 percentage points to the top NYC rate—raising it from about 3.9% to just under 6%—on income exceeding $1 million. This means someone earning $1.5 million would pay the baseline city rate on the first $1 million, then the higher marginal rate on the additional $500,000.

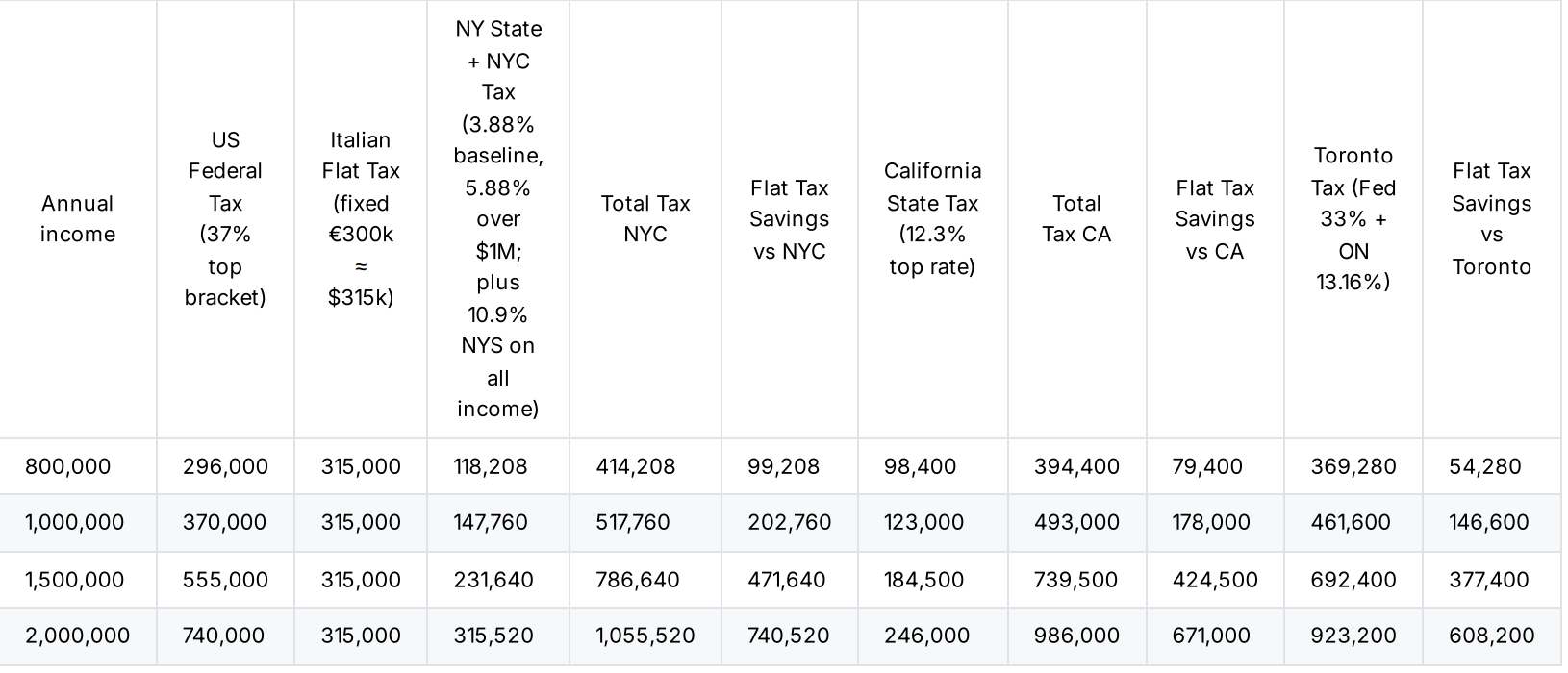

California's top state rate is still 12.3% and Ontario's is about 13.16% in 2026, combined with a 33% federal top rate, so combined top marginal rates in those jurisdictions can approach or exceed 50% for high earners in these locales. In Italy, you no longer pay these state or provincial taxes on your foreign income (but you still must file with the IRS or CRA to avoid double taxation). Here's a table to see how the savings could look (estimates for fiscal year 2026, now reflecting the €300,000 flat tax and Mamdani's proposed marginal rate increase on income over $1 million), using high‑level, simplified assumptions.

The flat tax becomes financially advantageous once your total tax liability in your home jurisdiction on foreign‑sourced income exceeds approximately €300,000. For NYC residents earning $800,000, savings under current rates in forecasted models are around $85,407 annually. If Mamdani's proposed 2‑percentage‑point marginal rate increase on income over $1 million is enacted, NYC earners at $1.5 million could save roughly $448,839 annually, while those at $2 million could save over $707,000 annually by relocating to Italy—representing extraordinary tax savings for high earners.

Special Considerations for Business Owners Planning an Exit

Italy's flat tax regime has no minimum annual income requirement—only that you establish and maintain Italian tax residency (183+ days per year) and have not been resident in Italy for 9 of the prior 10 years. This makes the regime particularly attractive for business owners anticipating a major liquidity event, such as a significant sale of equity in a closely held business or other large capital realization.

An important timing consideration:

If you sell a business where you hold "qualified" shareholdings (ownership exceeding 20% in a private company or 2% in a listed company), capital gains from that sale are taxed separately at 26% if completed within your first five years in the regime. However, after five years in the flat tax regime, capital gains on substantial shareholdings can in many cases be brought within the €300,000 annual flat tax, creating a valuable planning opportunity for those who can time a sale to occur after this initial window. This can potentially save millions compared to US capital gains tax rates of 36–40% (federal plus state/local), depending on structure and treaty relief.

Real estate note: In many planning structures, gains on foreign real estate can be brought within the scope of the €300,000 flat tax from year one, but treatment can vary by asset, holding vehicle, and source country, so investors should obtain specific advice rather than assuming that all property sales are automatically covered.

Living costs: more spending power in Italy

Relocating to Italy also cuts costs. According to cost‑of‑living indices such as Numbeo (September 2025), Rome's consumer prices (excluding rent) are around 40% lower than New York's, and rents are roughly 80% lower, implying significantly lower typical monthly expenses for a comparable lifestyle. San Francisco and Los Angeles are also much more expensive than Rome or Milan, with rents often $3,000+ per month compared to about €1,200–€1,800 in Italy’s major cities for similar long‑term accommodation. Access to Italy’s public health system reduces out‑of‑pocket medical expenses, and entry‑level private health‑insurance policies for younger, healthy individuals can start from around €50 per month, rising with age and coverage level.

What are the first application steps?

Start by applying for the Digital Nomad Visa at the Italian consulate in your country. You'll need to show proof of work, experience, income, insurance, and where you'll stay. When you arrive in Italy, complete the residency paperwork. You would then opt into the flat tax on your first Italian tax return. It is advisable to seek preliminary confirmation from the Agenzia delle Entrate—often through a ruling procedure—before you move or restructure assets, to confirm that you meet all conditions.

Need help in your application?

The process of relocating and establishing tax residency in Italy can be complex. It often involves securing key documentation such as the codice fiscale (tax identification number), registering your residence with the local Anagrafe (registry office), obtaining your SPID digital ID, and enrolling in the national health system or arranging private health insurance. Additionally, ensuring your tax registration with the Agenzia delle Entrate is properly completed is critical for compliance.

In need of help? As an English‑speaking expat lawyer for non‑EU nationals in Rome, I provide comprehensive support at each step—including visa applications, assistance with all local registrations, and help organizing your tax paperwork and digital identity setup. This approach is designed to make your transition to Italy as straightforward as possible. For questions or support with any part of the process, you can contact me at francesca@expatlawyerinitaly.com